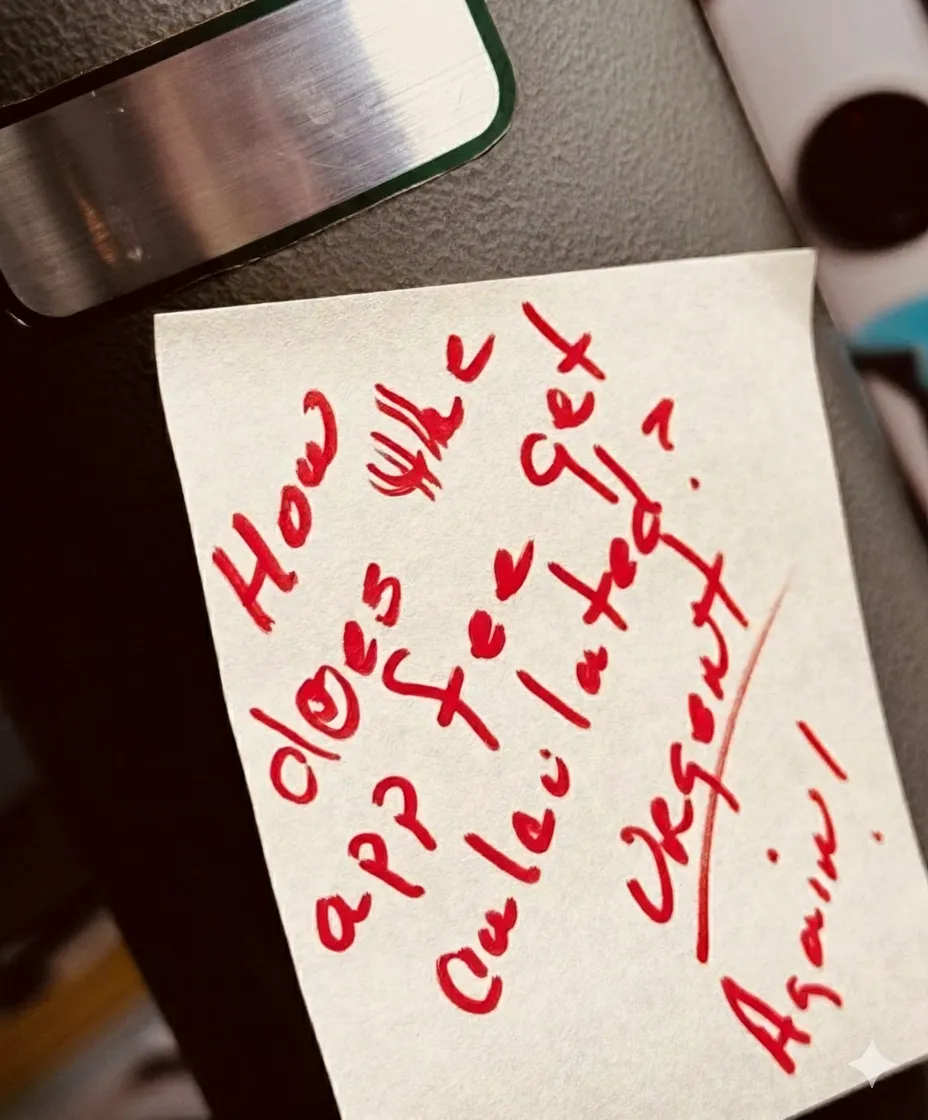

You've been there. Maybe it was during an OCC exam prep meeting. Maybe it was a Dodd-Frank compliance review. Or perhaps it was when your Chief Compliance Officer forwarded you yet another regulatory update with a yellow-highlighted section and a simple question: "Do we do this? Where?"

And you found yourself thinking: "I think we handle that in the claims processing batch job... or maybe it's in the policy administration system... actually, it might be split across both."

If you're an Enterprise Architect supporting financial services systems built on COBOL—and let's be honest, that's most of the critical stuff—you know this feeling intimately. Your compliance team needs answers about business logic that's been accumulating in your codebase for three decades. They need it documented. They need it traceable. And they need it yesterday.

The Compliance Problem Nobody Wants to Talk About

Here's what keeps me up at night, and I suspect it's the same for you: we're increasingly being asked to prove that our systems do what we say they do—not just at a high level, but with real traceability from regulatory requirement to actual code implementation.

The compliance frameworks keep evolving. The OCC wants to see how you're handling customer data. The CFPB wants documentation on fee calculations. The Federal Reserve wants to understand your risk models. And all of them want audit trails that show exactly how your business rules are implemented.

The problem? That knowledge exists in millions of lines of COBOL code written by developers who retired five years ago. Your current team can probably tell you what the code does at a program level. But explaining why a particular fee gets calculated the way it does, across six different batch programs and three databases? That's a different story.

The Hidden Compliance Tax

Let's talk about what this really costs you:

Audit Preparation Time: Your team spends weeks before each audit manually tracing through code to document business rules. It's expensive, it's error-prone, and there's always that nagging worry you missed something.

Regulatory Response Delays: When a regulator asks "How do you calculate X?" or "Where do you process Y?" you can't give them an answer in hours or days. It takes weeks of developer time to trace the logic, and by then, you're explaining why you couldn't respond faster.

Change Impact Analysis: Every time there's a new regulatory requirement, you face the same challenge: figuring out everywhere in your codebase that might be affected. Miss something, and you're non-compliant. Over-scope, and you waste budget on unnecessary changes.

Knowledge Transfer Risk: Your senior developers who understand these systems are retiring. Their knowledge of how business rules are actually implemented goes with them. And that knowledge gap becomes a compliance risk.

What You Actually Need (And Why Traditional Tools Fall Short)

You've probably looked at code analysis tools. Maybe you're already using IBM's ADDI or CAST or something similar. These tools are good at what they do—they can show you program structures, dependencies, and technical debt metrics.

But here's what they typically don't do well: explain business functions in terms your compliance team can actually use, not COBOL syntax. What is also missing? Tieing compliance documentation back to specific lines of code scattered across thousands of lines of code so you can prove you are compliant.

When your CCO asks "Show me how we calculate the annual percentage yield across all our savings products," you don't need a technical dependency diagram. You need to answer:

- What data inputs affect this calculation?

- What business rules and conditions are applied?

- Where are those rules actually implemented in the code?

- How do those implementations map to our documented policies?

That's a different kind of analysis—one focused on business function understanding rather than technical architecture.

A Different Approach: Understanding Business Functions First

This is where thinking about compliance differently can help. Instead of starting with compliance requirements and trying to trace them into your codebase, what if you could automatically extract the business functions that are actually implemented in your code?

Here's what I mean: Imagine you could automatically discover every place in your COBOL applications where fees are calculated, interest is accrued, or customer data is transformed. And not just find the programs involved, but actually understand the complete business logic—every condition, every transformation, every data source that influences the outcome—explained in plain language.

That's what business function discovery gives you. And it turns out, that's exactly what you need for most compliance activities.

Real-World Compliance Scenarios Where This Matters

Let me walk through a few situations you've probably faced:

Scenario 1: The Surprise Audit Question

You're three days into an OCC examination when the examiner asks: "Walk me through how your system ensures we're calculating interest correctly for customers in different states with different regulatory requirements."

Traditional approach: You gather your senior COBOL developers, they start manually tracing through code, and three days later you have partial documentation that shows some of the logic but probably misses some edge cases.

With business function understanding: You immediately pull up the complete documentation of your interest calculation business function. It shows every state code check, every regulatory variation, every data input that influences the calculation—automatically extracted from the actual code. You can hand this to the examiner same-day.

Scenario 2: New Regulatory Requirement

The CFPB issues new guidance on fee disclosure. You need to document all places where customer fees are calculated or presented, assess impact, and prove compliance.

Traditional approach: Manual code archaeology. Your team estimates 6-8 weeks to fully document all fee-related business logic across your loan origination, servicing, and collections systems.

With business function understanding: You search for all business functions related to fees, immediately see the complete inventory of where fees are calculated, and can assess impact in days instead of weeks. Better yet, you can show regulators exactly how your implementation aligns with the requirements.

Scenario 3: Data Privacy Compliance

You need to respond to a data privacy inquiry: "Show us how personally identifiable information flows through your mortgage processing system."

Traditional approach: Developers manually trace PII through programs, databases, and batch jobs. You're pretty sure you found everything, but there's always that doubt.

With business function understanding: You can automatically map data flows, see every transformation of PII, understand where it's stored and transmitted—and generate documentation that shows complete traceability from data entry to data retention.

The Documentation Problem

Let's be honest about another issue: even when you do have documentation of your business rules, it's often:

- Outdated (the code changed but the docs didn't)

- Incomplete (documents the happy path but not all the edge cases)

- Written for developers (not useful for compliance officers or auditors)

- Disconnected from the code (so you can't verify it's accurate)

What you really need is documentation that:

- Is automatically generated from the actual code

- Includes all the conditions and edge cases that actually exist

- Is explained in business terms that non-technical stakeholders can understand

- Can be traced directly back to specific lines of code for verification

This is what we mean when we talk about "making decades of invisible business knowledge visible." The knowledge is already in your code—it's just trapped in COBOL syntax that only a handful of people can interpret.

Not a Silver Bullet, But a Missing Piece

I want to be clear about something: COBOL Colleague isn't going to solve all your compliance problems. You still need good policies, strong controls, and robust compliance processes.

But here's what it does address: the fundamental challenge of understanding what your code actually does at a business logic level, in a way that's accessible to compliance teams, auditors, and business stakeholders.

It's the difference between:

- "We think our fee calculation follows the regulation" vs. "Here's the documented business function showing exactly how we comply"

- "It will take us 3 weeks to answer that audit question" vs. "Let me show you right now"

- "Our senior developer knows how this works" vs. "Here's the complete documentation anyone can understand"

The Strategic Compliance Advantage

There's another benefit worth mentioning: when you truly understand your business functions at this level, you shift from reactive compliance to strategic compliance.

Instead of waiting for audit questions, you can proactively document your critical business functions. Instead of scrambling when regulations change, you can quickly assess impact. Instead of hoping you haven't missed anything, you can demonstrate complete coverage.

This also positions you better for eventual modernization efforts. When you do decide to migrate systems or re-platform, you'll have complete documentation of the business logic you need to preserve—which is exactly what regulators want to see in modernization plans.

A Conversation Worth Having

Look, I know you're evaluating a lot of tools and approaches. You're probably skeptical about another vendor claiming to solve your legacy system challenges.

But if you're spending significant time and budget on compliance-related code analysis, if you're worried about audit readiness, if you're concerned about knowledge loss as experienced developers retire—this is a conversation worth having.

We've built something specifically for the problem of understanding business functions in COBOL codebases. It's designed for financial services compliance scenarios. And it addresses the specific gap that traditional code analysis tools don't cover.

Let's talk. Not about a sales pitch, but about your specific compliance challenges. We can show you exactly how business function discovery works with your code, and you can decide if it addresses problems you're actually facing.

Because at the end of the day, compliance shouldn't require code archaeology. Your business logic should be understandable, documentable, and defensible—regardless of how old your COBOL is.